Credit Repair Myths Debunked: Dividing Reality from Fiction

Credit Repair Myths Debunked: Dividing Reality from Fiction

Blog Article

How Credit Rating Repair Functions to Eliminate Errors and Increase Your Credit Reliability

Credit rating repair service is a vital procedure for people looking for to improve their creditworthiness by addressing mistakes that might jeopardize their monetary standing. By carefully analyzing credit report records for usual errors-- such as wrong individual details or misreported payment histories-- individuals can initiate an organized conflict process with debt bureaus.

Understanding Credit History News

Credit scores reports work as a financial picture of an individual's credit rating, outlining their loaning and payment behavior. These reports are put together by credit scores bureaus and include essential information such as credit accounts, impressive financial obligations, payment background, and public records like liens or bankruptcies. Economic institutions utilize this data to assess an individual's creditworthiness when getting car loans, charge card, or mortgages.

A credit rating record typically includes individual information, consisting of the person's name, address, and Social Safety and security number, along with a checklist of charge account, their status, and any late repayments. The report likewise describes credit rating inquiries-- circumstances where lending institutions have actually accessed the record for assessment objectives. Each of these components plays an important function in establishing a credit report, which is a numerical representation of credit reliability.

Comprehending credit history records is necessary for consumers intending to manage their economic wellness effectively. By regularly evaluating their reports, individuals can guarantee that their credit rating history precisely reflects their financial behavior, thus placing themselves favorably in future loaning undertakings. Understanding of the materials of one's credit rating report is the initial step towards successful credit history fixing and general financial health.

Common Debt Record Errors

Mistakes within credit score reports can significantly influence a person's credit history and total monetary wellness. Common credit rating record mistakes include incorrect individual information, such as incorrect addresses or misspelled names. These inconsistencies can cause complication and may influence the analysis of credit reliability.

An additional frequent error entails accounts that do not come from the person, frequently arising from identity theft or imprecise information entrance by creditors. Blended files, where one person's debt info is incorporated with one more's, can likewise happen, specifically with people who share comparable names.

Additionally, late repayments may be improperly reported because of refining mistakes or misunderstandings pertaining to settlement dates. Accounts that have been resolved or repaid could still look like exceptional, further complicating an individual's debt profile.

Furthermore, errors concerning debt restrictions and account balances can misrepresent a customer's credit rating use ratio, a critical variable in credit report. Identifying these errors is crucial, as they can cause higher rates of interest, finance rejections, and enhanced trouble in acquiring credit rating. Regularly evaluating one's credit score record is a positive procedure to identify and correct these usual mistakes, hence protecting financial health and wellness.

The Credit Report Repair Refine

Navigating the credit report repair service procedure can be an overwhelming job for many individuals looking for to enhance their financial standing. The trip begins with getting an extensive credit score record from all 3 significant credit scores bureaus: Equifax, Experian, and TransUnion. Credit Repair. This allows consumers to determine and understand the factors affecting their credit rating

As soon as the credit score record is reviewed, individuals need to categorize the info right into accurate, incorrect, and unverifiable products. Accurate details needs to be maintained, while mistakes can be disputed. It is necessary to gather sustaining paperwork to corroborate any claims of error.

Next, people can select to either take care of the procedure separately or get the help of professional debt repair solutions. Credit Repair. Specialists usually have the proficiency and sources to browse the complexities of credit rating reporting laws and can improve the procedure

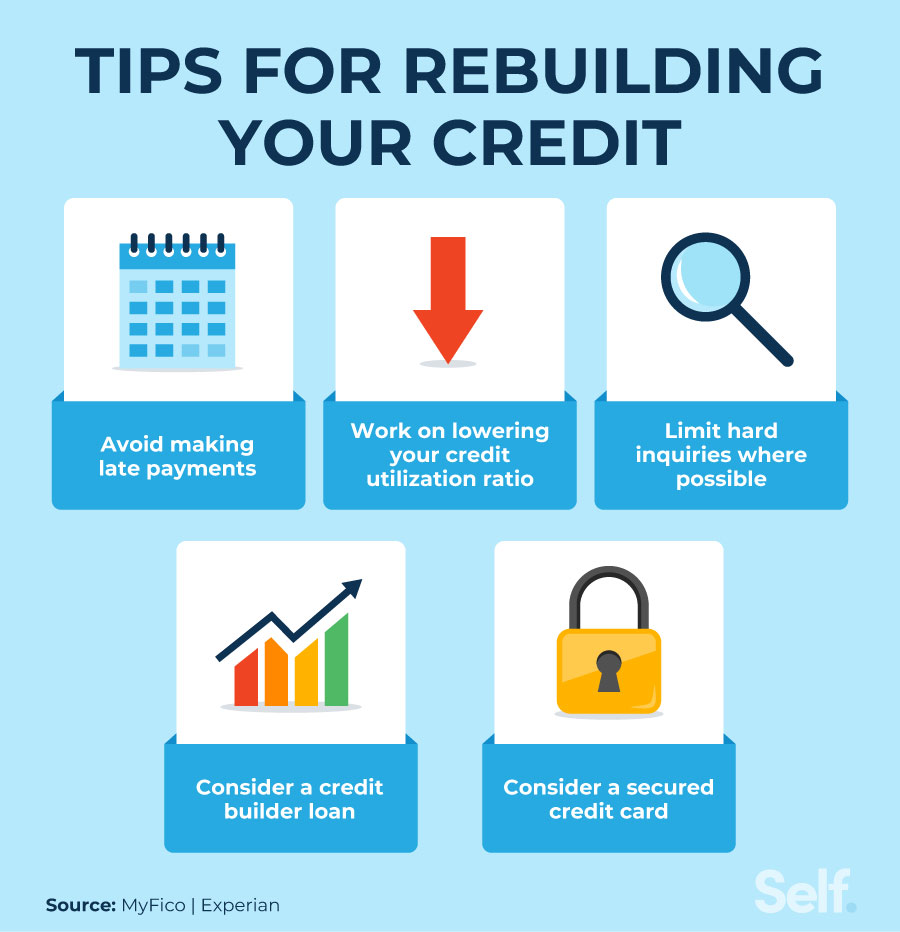

Throughout the credit rating fixing procedure, preserving prompt repayments on existing accounts is important. This demonstrates liable economic actions and can positively affect credit history. Ultimately, the credit repair process is a methodical method to recognizing problems, contesting errors, and fostering healthier financial habits, leading to improved credit reliability gradually.

Disputing Inaccuracies Properly

An efficient disagreement procedure is essential for those wanting to correct errors on their credit scores records. The initial action entails acquiring a copy of your credit rating record from the major credit rating bureaus-- Equifax, Experian, and TransUnion. Review the record carefully for any type of discrepancies, such as wrong account details, obsoleted information, or deceptive access.

Once errors are identified, it is vital to gather supporting documents that validates your insurance claims. This might include settlement invoices, financial institution statements, or any kind of pertinent document. Next, launch the conflict process by contacting the credit bureau that issued the record. This can normally be done online, through mail, or over the phone. When sending your disagreement, give a clear description of the mistake, along with the supporting evidence.

Advantages of Credit Rating Repair Work

A wide variety of advantages goes along with the process of credit score repair service, substantially impacting both financial stability and total you can try here lifestyle. One of the primary advantages is the potential for better credit score scores. As errors and inaccuracies are corrected, people can experience a notable boost in their creditworthiness, which straight influences financing authorization rates and passion Get the facts terms.

Additionally, credit report repair service can enhance accessibility to beneficial funding alternatives. People with higher credit rating are most likely to get reduced interest rates on home loans, vehicle fundings, and individual car loans, ultimately leading to significant savings gradually. This improved economic flexibility can assist in significant life decisions, such as buying a home or investing in education.

With a more clear understanding of their credit report circumstance, individuals can make informed selections pertaining to credit scores use and monitoring. Credit score fixing often includes education on financial literacy, encouraging individuals to embrace better investing habits and preserve their credit score health and wellness long-lasting.

Final Thought

To conclude, credit history repair work acts as a vital system for improving credit reliability by resolving errors within credit records. The methodical identification and disagreement of mistakes can result in significant enhancements in credit rating, consequently assisting in access to better funding alternatives. By recognizing the nuances of credit history records and using reliable dispute methods, individuals can attain higher economic health and wellness and security. Ultimately, the credit history fixing process plays a necessary role in promoting informed monetary decision-making and long-lasting financial health and wellbeing.

By carefully analyzing credit check here reports for common errors-- such as incorrect individual information or misreported payment histories-- people can launch a structured dispute process with credit score bureaus.Debt records serve as an economic photo of a person's credit rating background, outlining their borrowing and repayment behavior. Recognition of the components of one's credit scores record is the first action towards effective credit scores repair and total monetary well-being.

Errors within credit history reports can dramatically impact an individual's credit score and total economic health.In addition, mistakes regarding credit score limitations and account equilibriums can misrepresent a customer's credit usage ratio, an important factor in credit score scoring.

Report this page